A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death.

Living trust forms illinois.

The use of a living trust is an important estate planning.

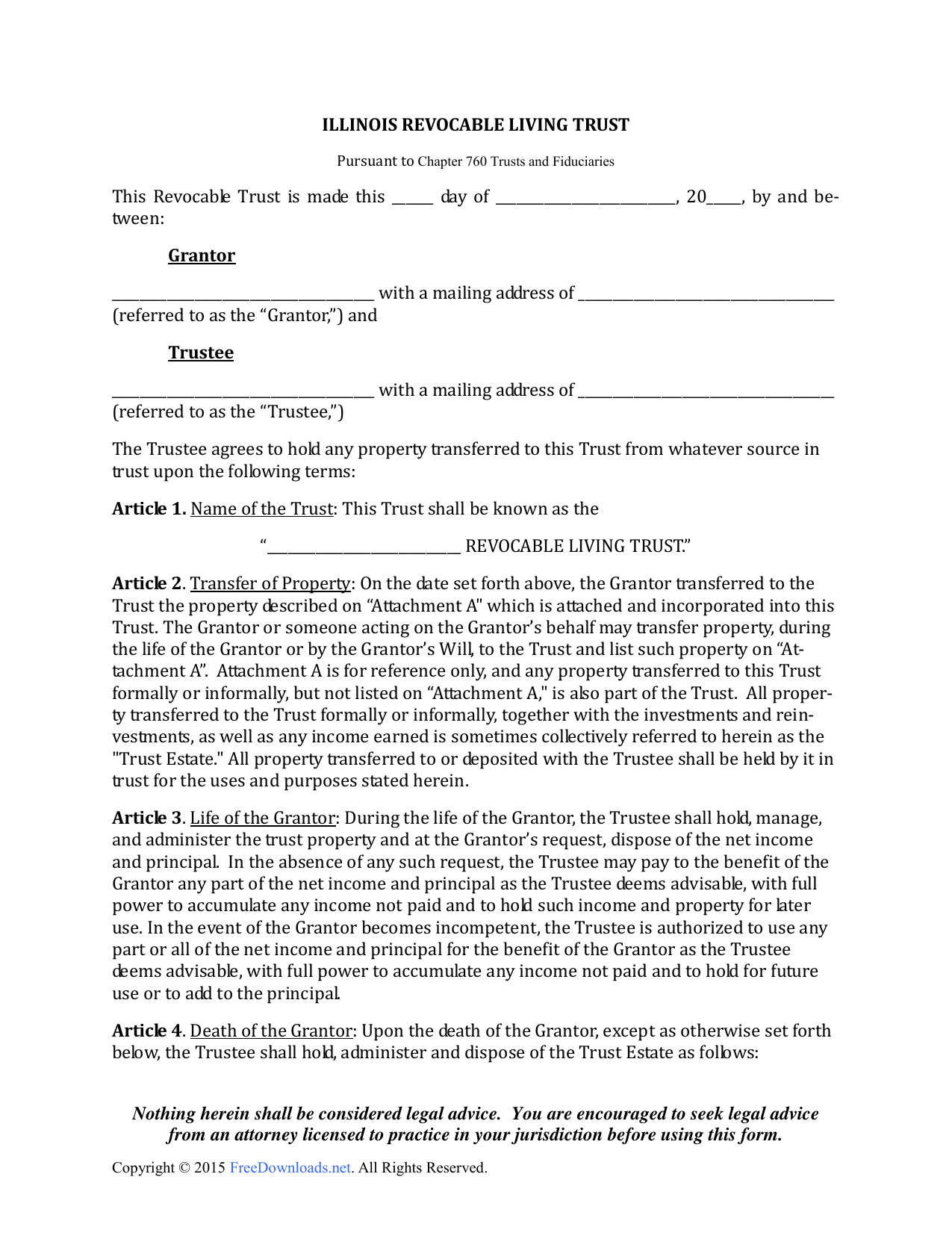

Illinois revocable living trust form the illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois.

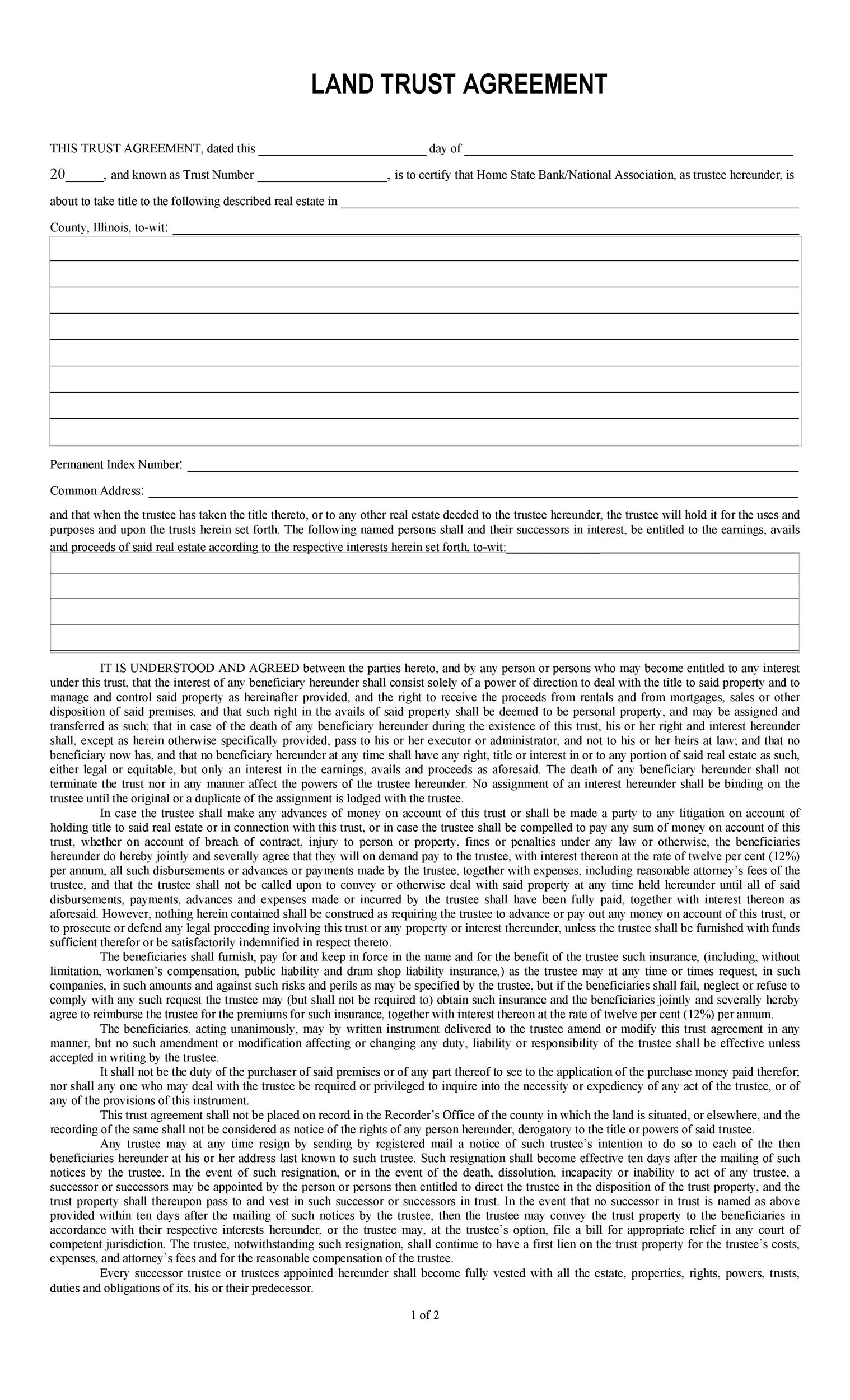

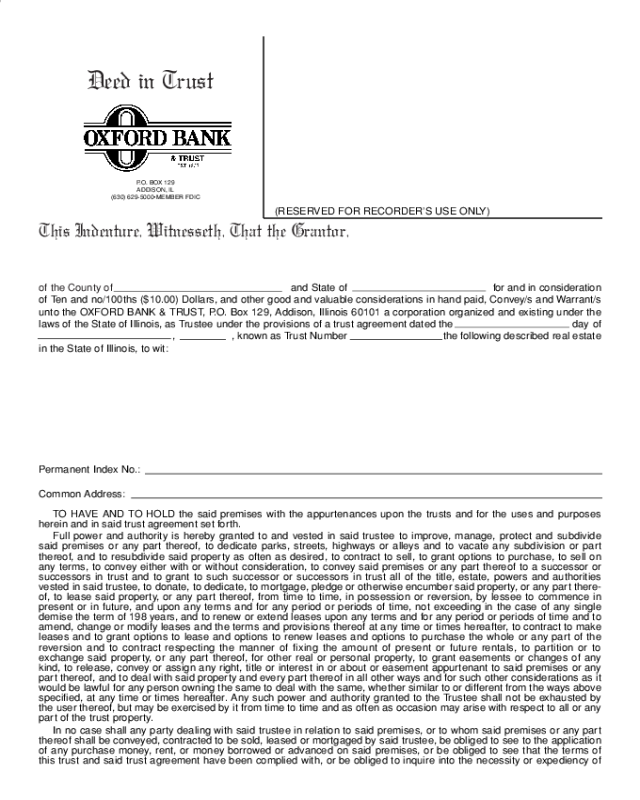

In its simplest form a trust is the designation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

Our free illinois living trust forms are very popular estate planning tools that can be utilized to avoid probate and court supervision of your assets.

What is a trust.

Illinois has a simplified probate process for small estates under 100 000 excluding real estate.

The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime.

Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any.

A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

Illinois living trust forms download the illinois living trust that allows a person called a grantor to set aside assets and property into a separate entity by which he or she can specify how when and to whom the property and assets are distributed.

In its simplest form a trust is the desig nation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

Unlike a will a trust does not go through the probate process with the court.

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

See information on back panel concerning illinois lawyer finder.

An illinois living trust form is a legal document that is drafted to transfer a person s assets on to their named beneficiaries upon death.

To add real estate to a living trust the grantor s of the trust create a real property deed with the living trust named as grantee.

Illinois does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid illinois s complex probate process.