Making these upgrades helps to lower the demand on a home s heating ventilation and air conditioning hvac systems which means that the same level of indoor comfort heating and cooling services can be achieved with smaller more efficient and more economical units.

Government incentives for attic insulation.

See a state by state directory of such programs here.

The federal government has reinstated the federal 25c tax credit program until december 31 2020.

Learn more about the tax credit.

How much to buy.

Most federal tax credits for weatherizing your house and boosting its energy efficiency expired in 2011.

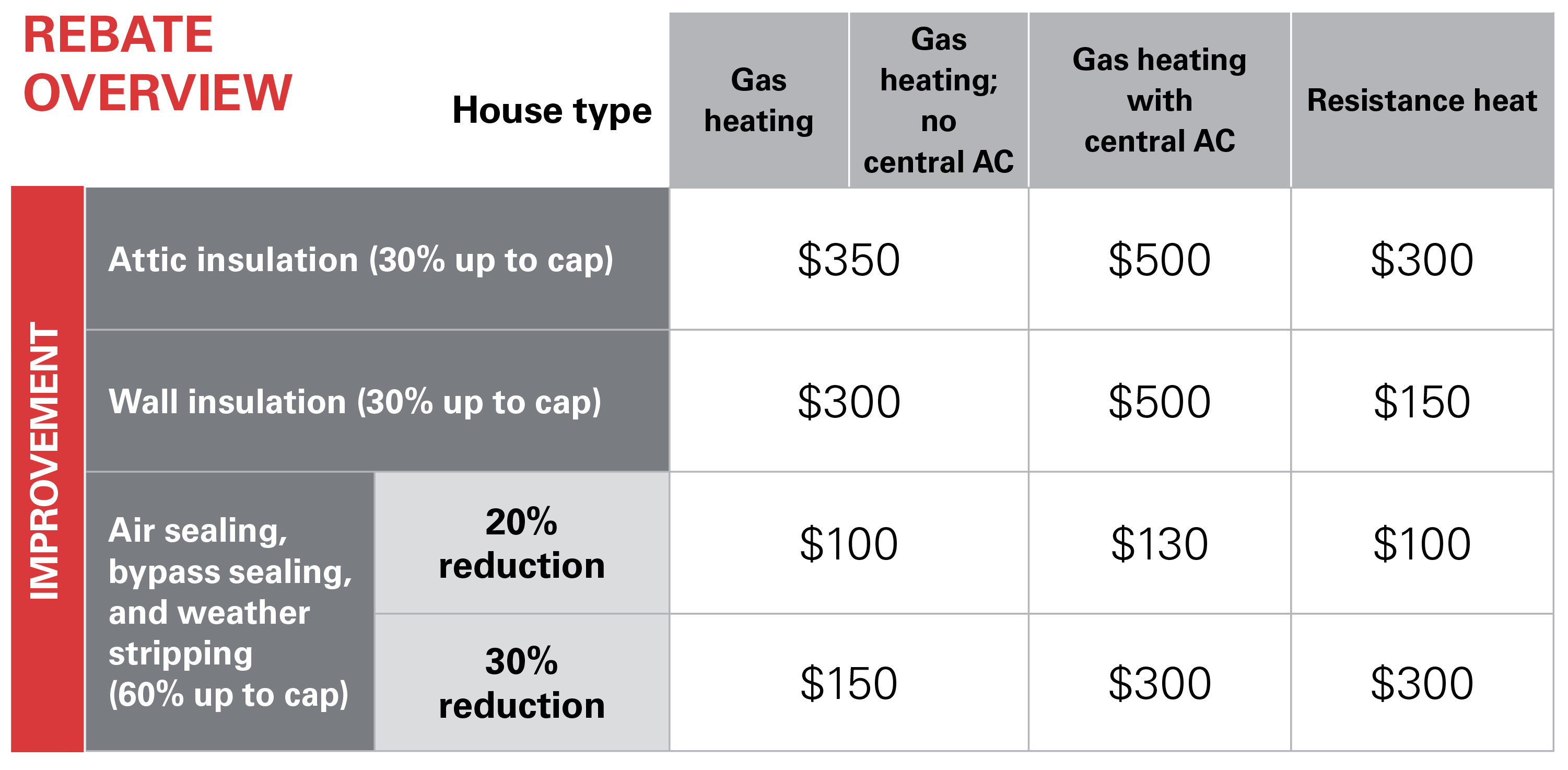

But your state s energy office or local utility may offer product rebates discounts or other financial incentives for insulating.

Icynene spray foam insulation is a premium insulation product that you can indeed afford to invest in.

Section 25c tax credit for qualified energy efficiency improvements offers a 10 tax credit worth up to 500 for homeowners for qualified energy efficiency upgrades such as building insulation.

750 attic insulation increase from a starting point.

Check with the following for rebates incentives in.

The federal government offers tax credits on energy efficiency products too.

It s possible for you to make the investment in icynene premium insulation thanks to local home insulation rebate and incentive programs that are available in your county city or state.

10 of the cost up to 500 requirements typical bulk insulation products can qualify such as batts rolls blow in fibers rigid boards expanding spray and pour in place.

With up to 475 for insulation 40 per door and 15 per window rated energy star northern climate zone you can earn a lot back on your upgrades while saving on your energy bill too.

Ontario homeowners can get government of canada ecoenergy grants for increasing attic or roof insulation.

Also with the new home efficiency rebate initiative comes the addition of a new rebate.

That s why we offer you rebates to support your upgrades.

The maximum total amount that can be claimed for all products placed in service in 2011 for most home improvements is 10 of cost up to 500 except for geothermal heat pumps solar water heaters solar panels fuel cells and small wind energy systems that are not subject to this cap and are in effect through 2017.

2000 is available to homeowners who add at least r20 insulation to the entirety of the exterior walls of their home.

Common structural rebates include those for adding attic insulation and shading or replacing old or inefficient windows.

Homeowners can be eligible for a tax credit of up to 500 or 10 of qualified energy efficiency improvements such as insulation.

There are a number of substantial rebates available to homeowners who improve their home s insulation.

Of up to r12 to achieve total minimum insulation value of r 50 rsi 8 81 500 attic insulation increase from a starting point.

Irs energy efficiency tax credit for homeowner.